About Thoroughbred Dealer Services

TDS measures its success based on the success of its customers.

Thoroughbred Dealers Services was started from a desire to provide independent used car dealers with an affordable means to acquire assistance in their day to day operations and valuable professional services.

About Thoroughbred Dealer Services

Thoroughbred Dealer Services

We developed the TOP RATED DMS to manage your inventory, prospects, and Forms. Print your paperwork quickly and accurately from anywhere in the world! Welcome to the future of Dealer Management Systems!

Since 2010, Thoroughbred Dealer Services has been family-owned and operated. The company measures its success based on the success of its customers. QuickSoft Dealer Management Software was founded by TDS in 2017 a simple, fast, and affordable way for independent dealers and brokers to document sales and track their inventory with the flexibility to make a sale from anywhere on any device.

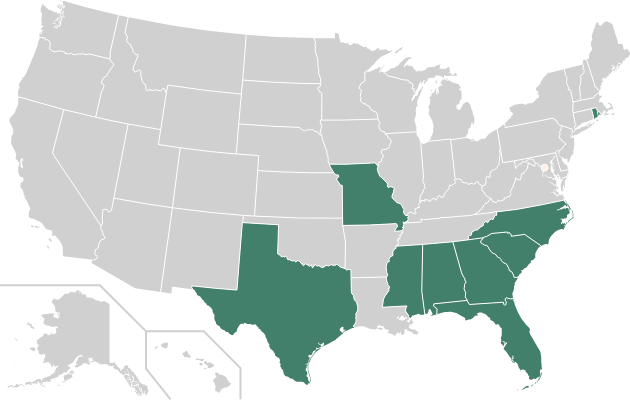

TDS Service Area

Coverage across the Southeast

Thoroughbred Dealer Services knows car dealers and we know the southeast. TDS has customers in Georgia, Alabama, Florida, Texas, Mississippi, North and South Carolina, Missouri, and Rhode Island.

We have insurance and bond products and solutions that can meet your state’s minimum limits and beyond. We can provide comprehensive and collision coverage for your vehicles. Ask us about uninsured motorist coverage!

Pre-License Prep Course

Prepare for your license with a comprehensive pre-license prep course, providing the necessary tools and knowledge for success.

Corporate Filings

Streamline your corporate filings with our efficient service, ensuring accurate and timely submission of all required documents.

Dealer Insurance

Secure your dealership with comprehensive insurance coverage designed specifically to meet the unique needs of automotive dealerships.

License Processing

Simplify the process of license processing with our efficient services, ensuring a smooth and timely completion of all necessary requirements.

You're Open For Business

We are ready to serve you and assist with all your business needs, ensuring a seamless and successful experience.

QuickSoft DMS is the future of car sales.

We developed the TOP RATED DMS to manage your inventory, prospects, and Forms. Print your paperwork quickly and accurately from anywhere in the world! Welcome to the future of Dealer Management Systems!

Since 2010, Thoroughbred Dealer Services has been family-owned and operated. The company measures its success based on the success of its customers. QuickSoft Dealer Management Software was founded by TDS in 2017 a simple, fast, and affordable way for independent dealers and brokers to document sales and track their inventory with the flexibility to make a sale from anywhere on any device.

Support

Frequently Asked Dealer Insurance Questions

Find answers to commonly asked questions about dealer insurance, providing valuable insights and guidance to help you make informed decisions for your dealership’s insurance needs.

What does a garage liability policy usually cost?

Your quotes through us are free.

When it comes to insurance premiums, however, it depends. Insurance carriers collect motor vehicle records, loss runs, and rate policies based on the number of employees you have at your business. The number of drivers with furnished use of dealer plates will also affect the price of a liability premium. Also, the more coverage you want, the more it affects the premium.

What do I need for a quote?

In short, basic information for an insurance quote is included in the application above.

For established businesses, insurance companies will ask for your insurance history and require loss runs (a record of claims with your prior insurance carriers). Companies may also pull motor vehicle dealer records to rate drivers on the policy.

Does the credit pull for a dealer bond affect my credit?

No. Our bond partners use a soft credit pull to rate your bond that will not affect your credit score.

How long does a quote usually take?

We typically have a response from our underwriting office in 24-48 hours.

How long are policy terms?

Our commercial policy terms last 12 months.

Can I finance my policy?

Yes! We offer finance options for our customers premiums.

Testimonial

What our clients are saying

Discover what our clients have to say about their experiences with Thoroughbred Dealer Services, as they share their testimonials and feedback about our exceptional services and customer satisfaction.

BLOGS

Latest News

Stay informed with our latest news updates, delivering relevant and timely information on industry trends, market insights, regulatory changes, and other important developments that may impact your business.